CALGARY, AB, May 29, 2024 /CNW/ - Surge Energy Inc. ("Surge" or the "Company") (TSX: SGY) is pleased to announce a number of recent positive operational and financial developments, including: the sale of certain non-core assets, achievement of Management's Phase 2 net debt1 target, an anticipated increase to Surge's base dividend, the intention to institute a normal course issuer bid ("NCIB"), and a large new Sparky crude oil discovery.

In addition, Surge has scheduled a conference call and webcast in respect of this press release to begin promptly at 9:00 am MT (11:00 am ET) on Thursday, May 30, 2024. The conference call dial-in number is: 1-888-664-6392 or (416) 764-8677.

RECENT POSITIVE DEVELOPMENTS AT SURGE

Over the past several weeks, Surge has experienced a number of positive operational and financial developments, including the following:

1. Sale of Non-Core Assets:

On May 29, 2024, Surge closed the sale of two non-core assets at Shaunavon and Westerose (the "Non-Core Assets"), for total net proceeds of $37.4 million (the "Non-Core Asset Sales"). The Non-Core Assets have associated production of 1,100 boepd and generate annual cash flow from operating activities of approximately $10 million2. The net proceeds from the Non-Core Asset Sales have been applied against the Company's outstanding debt on its revolving first lien credit facility. Following the Non-Core Asset Sales, Surge has approximately $40 million of debt drawn on the Company's recently re-confirmed $210 million first lien credit facility.

After giving effect to the $37.4 million of Non-Core Asset Sale proceeds, the associated interest expense savings, and the timing of the dispositions, Surge estimates an impact of only $5 million on the Company's previously announced 2024e cash flow from operating activities guidance of $295 million2 - while substantially accelerating returns to Company shareholders, as set forth below.

2. Commencement of Phase 2 Return of Capital Framework: Share Buy Backs & Increase to Base Dividend:

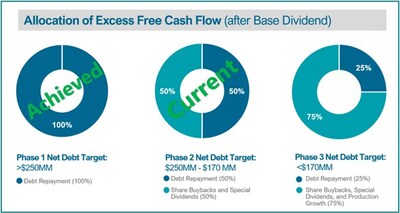

Surge is pleased to announce that the Company has now reduced its net debt below Management's previously stated $250 million target and has reached Phase 2 of its Return of Capital Framework.

With the commencement of Phase 2 of the Return of Capital Framework, the Company now forecasts having $52 million of excess free cash flow ("FCF")1 (after base dividends) annually to allocate, based on US$75 WTI per barrel oil pricing.

Surge's Board and Management anticipate allocating the $52 million of excess FCF as follows:

a) $48 million is forecast to be directed to share buybacks and continued net debt reduction. Within Phase 2 of Surge's Return of Capital Framework, the Company is now targeting a return of up to 50 percent of excess FCF to its shareholders by way of share buybacks, with the remainder directed to further reductions to Surge's net debt; and

b) $4 million will be allocated to Surge's base dividend; raising the dividend per share from $0.48 annually to an anticipated $0.52 annually (an 8 percent increase), effective for the July 15, 2024 dividend announcement, payable August 15, 2024. Any dividend increase will be subject to the approval of Surge's Board of Directors, with consideration given to the business environment at the time the dividend is approved.

___________ |

1 This is a non-GAAP and other financial measure which is defined in Non-GAAP and Other Financial Measures. |

2 Pricing assumptions: US$75 WTI, US$16 WCS differential, US$3.50 EDM differential, $0.725 CAD/USD FX and $2.95 AECO. |

3. Intention to Institute NCIB:

Surge's Board of Directors and Management have determined that the Company will seek TSX approval to institute a NCIB, pursuant to which Surge would be permitted to acquire up to 10 percent of its issued and outstanding common shares that comprise the public float, through the facilities, rules and regulations of the TSX.

Surge plans to file a notice of intention to make a NCIB with the TSX. The NCIB will be subject to receipt of certain approvals, including acceptance of the notice of intention by the TSX. The NCIB will commence following receipt of all such approvals and will continue for a period of up to one year, further particulars of which will be described in a subsequent press release.

The NCIB provides an additional, strategic, capital allocation alternative for the distribution of excess FCF in order to increase returns to the Company's shareholders. Surge's Board and Management believe that at times the prevailing trading price of Surge common shares does not reflect the underlying value of the common shares, and as such, the repurchase of Surge common shares represents an opportunity to enhance per share metrics.

Surge remains focused on a balanced Return of Capital Framework, incorporating base dividend payments, share buybacks and continued net debt repayment.

4. New Phase 3 Net Debt Target:

Given the 1,100 boepd of Non-Core Asset Sales referred to above, Surge has now adjusted the Company's Phase 3 ("terminal") net debt target to $170 million, from $175 million previously, as set forth in the infographic below:

Click this link to view PDF version of this release: https://surgeenergy.mediaroom.com/download/SGY-May-2024-Press-Release.pdf

Within Phase 2 of Surge's Return of Capital Framework, the Company is now targeting a return of up to 50 percent of excess FCF to its shareholders by way of share buybacks, with the remainder directed to further reductions to Surge's net debt.

As Surge reaches its Phase 3 "terminal" net debt target of $170 million, Surge's Management and Board will look to return up to 75 percent of excess FCF to shareholders through share buy backs, while considering the addition of an annual production per share growth target (3 to 5 percent per year).

5. New Sparky Oil Discovery at Hope Valley:

Over the last four years, Surge has now assembled a 32.5 net section block of land on an exciting new Sparky play trend, called Hope Valley. As part of the May 29, 2024 Alberta Crown sale, Surge strategically acquired 7.0 net sections of prospective land on the Hope Valley Sparky play trend.

The Company has now drilled 3 successful multi-leg oil wells in Hope Valley, which has established it as an exciting new crude oil discovery in the Sparky formation. Surge has now identified the potential for up to 100 multi-lateral drilling locations3 at Hope Valley. Surge's technical interpretation of its recent 46 square kilometer 3-D seismic program has allowed the Company to de-risk these future drilling locations in Hope Valley.

Production from Surge's latest Hope Valley well (the first well drilled incorporating the new 3-D seismic data) has exceeded Management's type curve with a IP60 day production average of 255 bopd3.

For the balance of 2024, Surge is planning 6 additional multi-lateral wells targeting the Sparky formation at Hope Valley. In addition, Surge is building a multi-well oil battery to accommodate planned future growth in the area.

__________ |

3 See Drilling Inventory. |

6. Strategic Hedging Program:

With oil prices continuing to exceed Surge's 2024 budget guidance price of US $75 WTI, and Western Canadian Select ("WCS") differentials dropping well below budget levels, Surge Management has strategically started to lock in oil price and differential hedges at better than budget guidance price levels.

Surge systematically uses primarily fixed price swaps, collars, and put purchases to lock in commodity prices and crude oil differentials, with the objective of protecting Surge's capital program and dividend, while maintaining significant exposure to the upside in crude oil prices.

7. 2024 Guidance Update:

As a result of the Non-Core Asset Sales referred to above, the Company's 2024 exit rate production guidance is now 24,000 boepd (86 percent light/medium oil). Capital expenditures for 2024 remain unchanged at $190 million and forecast cash flow from operating activities for the balance of 2024 has been reduced by $5 million.

Further details relating to Surge's 2024 budget guidance are set forth below:

Guidance | Previous Guidance @ US $75 WTI4 | Revised Guidance** @ US $75 WTI4 |

Exit 2024 production | 25,000 boepd (87% liquids) | 24,000 boepd (86% liquids) |

2024(e) Exploration and development expenditures | $190 million | $190 million |

2024(e) Cash flow from operating activities* | $295 million | $290 million |

2024(e) Free cash flow (before dividends) | $105 million | $100 million |

2024(e) Base Dividend Payments | $48 million | $50 million |

2024(e) All-in payout ratio5 | 81 % | 83 % |

2024(e) Exit net debt to 2024(e) cash flow from operating activities ratio5 | 0.7x | 0.7x |

2024(e) Royalties as a % of petroleum and natural gas revenue | 18.00 % | 18.00 % |

2024(e) Net operating expenses5 | $19.95 - $20.95 per boe | $19.50 - $20.45 per boe |

2024(e) Transportation expenses | $1.50 - $1.75 per boe | $1.50 - $1.75 per boe |

2024(e) General & administrative expenses | $2.15 - $2.35 per boe | $2.15 - $2.35 per boe |

* Cash flow from operating activities assumes a nil change in non-cash working capital. |

__________ |

4 Additional pricing assumptions (WCS: US$16.00, EDM US$3.50 differentials), CAD/USD FX of $0.725 and AECO of $2.95 per mcf. |

5 This is a non-GAAP and other financial measure which is defined in Non-GAAP and Other Financial Measures. |

OUTLOOK: THE PATH TO VALUE MAXIMIZATION

Surge's strong cash flow from operating activities and low 24 percent annual corporate production decline, together with an annual capital budget of just $190 million, have combined to generate one of the highest FCF yields6 in the Company's Canadian public peer group7.

Given the early achievement of Surge's Phase 2 net debt target, and the Non-Core Asset Sales, the Company now forecasts having $52 million of excess FCF to allocate, after paying its current base dividend to shareholders.

Consequently, the Company now anticipates allocating $48 million of this excess FCF to share buybacks, and to continued net debt reduction. The remaining $4 million of excess FCF is anticipated to be allocated to an 8 percent increase to Surge's base dividend.

As Surge reaches its Phase 3 "terminal" net debt target of $170 million, Surge's Management and Board will consider adding an annual production per share growth target (3 to 5 percent per year), as well as assess the efficacy of additional share buy backs and/or special dividends.

__________ |

6 This is a non-GAAP and other financial measure which is defined in Non-GAAP and Other Financial Measures. |

7 Per Peters&Co "Energy Update" dated May 21, 2024. |

Forward-Looking Statements

This press release contains forward-looking statements. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: Surge's anticipations regarding 2024 excess FCF and the allocation thereof, including the commencement of a NCIB, debt repayment and an anticipated increase to its base dividend; the impact of the Non-Core Asset Sales on Surge's 2024e cash flow from operating activities; Surge's intention to make an application to the TSX to commence a NCIB and the timing thereof; Surge's expectations regarding crude oil prices and net original oil in place on its lands; Surge's plans to drill additional multi-lateral wells for the balance of 2024; Surge's updated 2024 guidance; the addition of an annual production per share growth target; and management's strategy regarding achievement of its Phase 3 net debt target.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions around the performance of existing wells and success obtained in drilling new wells; anticipated expenses, cash flow and capital expenditures; the application of regulatory and royalty regimes; prevailing commodity prices and economic conditions; development and completion activities; the performance of new wells; the successful implementation of waterflood programs; the availability of and performance of facilities and pipelines; the geological characteristics of Surge's properties; the successful application of drilling, completion and seismic technology; the determination of decommissioning liabilities; prevailing weather conditions; exchange rates; licensing requirements; the impact of completed facilities on operating costs; the availability and costs of capital, labour and services; and the creditworthiness of industry partners.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the condition of the global economy, including trade, public health and other geopolitical risks; risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks); commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions; uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures; and failure to obtain the continued support of the lenders under Surge's bank line. Certain of these risks are set out in more detail in Surge's AIF dated March 6, 2024 and in Surge's MD&A for the period ended December 31, 2023, both of which have been filed on SEDAR+ and can be accessed at www.sedarplus.ca.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Oil and Gas Advisories

The term "boe" means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. "Boe/d" and "boepd" mean barrel of oil equivalent per day. Bbl means barrel of oil and "bopd" means barrels of oil per day. NGLs means natural gas liquids.

This press release contains certain oil and gas metrics and defined terms which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar metrics/terms presented by other issuers and may differ by definition and application. All oil and gas metrics/terms used in this document are defined below:

Original Oil in Place ("OOIP") means Discovered Petroleum Initially in Place ("DPIIP"). DPIIP is derived by Surge's internal Qualified Reserve Evaluators ("QRE") and prepared in accordance with National Instrument 51-101 and the Canadian Oil and Gas Evaluations Handbook ("COGEH"). DPIIP, as defined in COGEH, is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of DPIIP includes production, reserves and Resources Other Than Reserves (ROTR). OOIP/DPIIP and potential recovery rate estimates are based on current recovery technologies. There is significant uncertainty as to the ultimate recoverability and commercial viability of any of the resource associated with OOIP/DPIIP, and as such a recovery project cannot be defined for a volume of OOIP/DPIIP at this time. "Internally estimated" means an estimate that is derived by Surge's internal QRE's and prepared in accordance with National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities. All internal estimates contained in this news release have been prepared effective as of January 1, 2024.

As of May 29, 2024, Surge's internally estimated OOIP of the Hope Valley area is approximately 175 million barrels of oil, with a negligeable total estimated recovery factor to date.

Drilling Inventory

This press release discloses drilling locations in two categories: (i) booked locations; and (ii) unbooked locations. Booked locations are proved locations and probable locations derived from an internal evaluation using standard practices as prescribed in COGEH and account for drilling locations that have associated proved and/or probable reserves, as applicable.

Unbooked locations are internal estimates based on prospective acreage and assumptions as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by Surge's internal certified Engineers and Geologists (who are also Qualified Reserve Evaluators) as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill any or all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Surge's internally used type curves were constructed using a representative, factual and balanced analog data set, as of January 1, 2024. All locations were risked appropriately, and Estimated Ultimate Recoverable ("EUR") reserves were measured against OOIP estimates to ensure a reasonable recovery factor was being achieved based on the respective spacing assumption. Other assumptions, such as capital, operating expenses, wellhead offsets, land encumbrances, working interests and NGL yields were all reviewed, updated and accounted for on a well-by-well basis by Surge's Qualified Reserve Evaluators. All type curves fully comply with Part 5.8 of the Companion Policy 51 – 101CP.

Assuming a January 1, 2024 reference date, the Company will have over >1,150 gross (>1,050 net) drilling locations identified herein; of these >615 gross (>575 net) are unbooked locations. Of the 489 net booked locations identified herein, 397 net are Proved locations and 92 net are Probable locations based on Sproule's 2023 year-end reserves. Assuming an average number of net wells drilled per year of 80, Surge's >1,050 net locations provide 13 years of drilling.

Assuming a January 1, 2024 reference date, the Company will have over >475 gross (>470 net) Sparky Core area drilling locations identified herein; of these >285 gross (>285 net) are unbooked locations. Of the 186 net booked locations identified herein, 140 net are Proved locations and 46 net are Probable locations based on Sproule's 2023 year-end reserves. Assuming an average number of net wells drilled per year of 40, Surge's >470 net locations provide >11 years of drilling.

Assuming a May 29, 2024 reference date, the Company will have over >60 gross (>60 net) Hope Valley area drilling locations identified herein; of these >50 gross (>50 net) are unbooked locations. Of the 9 net booked locations identified herein, 6 net are Proved locations and 3 net are Probable locations based on Sproule's 2023 year-end reserves.

Surge's internal Hope Valley type curve profile of 172 bopd (IP30), 171 bopd (IP60) and 175 mbbl (175 mboe) EUR reserves per well, with assumed $2.8 MM per well capital, has a payout of ~10 months @ US$80/bbl WTI (C$105/bbl LSB) and a ~190% IRR.

Non-GAAP and Other Financial Measures

This press release includes references to non-GAAP and other financial measures used by the Company to evaluate its financial performance, financial position or cash flow. These specified financial measures include non-GAAP financial measures and non-GAAP ratios, are not defined by IFRS and therefore are referred to as non-GAAP and other financial measures. Certain secondary financial measures in this press release – namely "free cash flow", "free cash flow per share", "free cash flow yield", "net debt", "net debt to cash flow from operating activities", "all-in payout ratio", "net operating expenses", and "net operating expenses per boe" are not prescribed by GAAP. These non-GAAP and other financial measures are included because management uses the information to analyze business performance, cash flow generated from the business, leverage and liquidity, resulting from the Company's principal business activities and it may be useful to investors on the same basis. None of these measures are used to enhance the Company's reported financial performance or position. The non-GAAP and other financial measures do not have a standardized meaning prescribed by IFRS and therefore are unlikely to be comparable to similar measures presented by other issuers. They are common in the reports of other companies but may differ by definition and application. All non-GAAP and other financial measures used in this document are defined below.

Free Cash Flow, Free Cash Flow per Share and Free Cash Flow Yield

Free cash flow ("FCF") is a non-GAAP financial measure, calculated as cash flow from operating activities, before changes in non-cash working capital, less expenditures on property, plant and equipment and dividends paid. Management uses FCF to determine the amount of funds available to the Company for future capital allocation decisions.

FCF per share is a non-GAAP ratio, calculated using the same weighted average basic and diluted shares used in calculating income (loss) per share. FCF yield is a non-GAAP ratio, calculated as FCF per share divided by the current share price.

Net Debt and Net Debt to Cash Flow from Operating Activities

Net debt is a non-GAAP financial measure, calculated as bank debt, term debt, plus the liability component of the convertible debentures plus current assets, less current liabilities, however, excluding the fair value of financial contracts, decommissioning obligations, and lease and other obligations. This metric is used by management to analyze the level of debt in the Company including the impact of working capital, which varies with timing of settlement of these balances.

Net debt to cash flow from operating activities is a non-GAAP ratio, calculated as exit net debt divided by cash flow from operating activities. Management uses this ratio to measure the Company's overall debt position and to measure the strength of the Company's balance sheet. Surge monitors this ratio and uses this as a key measure in making decisions regarding financing, capital expenditures and dividend levels.

All-in Payout Ratio

All-in payout ratio is a non-GAAP ratio, calculated as exploration and development expenditures, plus dividends paid, divided by cash flow from operations. This capital management measure is used by management to analyze allocated capital in comparison to the cash being generated by the principal business activities.

Net Operating Expenses and Net Operating Expenses per boe

Net operating expenses is a non-GAAP financial measure, determined by deducting processing income primarily generated by processing third party volumes at processing facilities where the Company has an ownership interest. It is common in the industry to earn third party processing revenue on facilities where the entity has a working interest in the infrastructure asset. Under IFRS this source of funds is required to be reported as revenue. However, the Company's principal business is not that of a midstream entity whose activities are dedicated to earning processing and other infrastructure payments. Where the Company has excess capacity at one of its facilities, it will look to process third party volumes as a means to reduce the cost of operating/owning the facility. As such, third party processing revenue is netted against operating costs when analyzed by Management.

Net operating expenses per boe is a non-GAAP ratio, calculated as net operating expenses divided by total barrels of oil equivalent produced during a specific period of time.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility of the accuracy of this release.

SOURCE Surge Energy Inc.