CALGARY, Sept. 5, 2018 /CNW/ - Surge Energy Inc. ("Surge" or the "Company") (TSX: SGY) and Mount Bastion Oil and Gas Corp. ("Mount Bastion" or "MBOG") have announced that they have entered into an arrangement agreement (the "Arrangement Agreement"), pursuant to which Surge has agreed to acquire all of the issued and outstanding common shares of MBOG ("MBOG Shares") by way of a statutory arrangement (the "Transaction").

The Transaction is 11 percent accretive to Surge's forecast 2019 adjusted funds flow per share1, and adds over 600 million barrels of net internally estimated light original oil in place ("OOIP"2), concentrated reserves, production, land, and operations. The addition of the MBOG assets (the "MBOG Assets") increases Surge's operating netback per boe by 12 percent, and is forecast to add over $85 million of net operating income1 in 2019.

Surge anticipates increasing its dividend by 25 percent, from $0.10 per share annually ($0.00833 per month) to $0.125 per share annually ($0.0104 per month), while improving Surge's all-in payout ratio from 89 percent to 87 percent. Any dividend increase will be subject to the approval of Surge's Board of Directors with consideration given to the business environment upon closing of the Transaction.

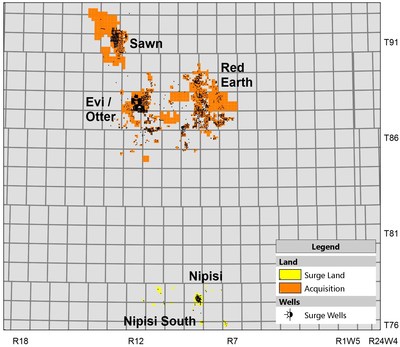

The MBOG Assets include 5,500 boepd (98 percent liquids) of operated, light oil production from the structural reef complexes within the geological Beaverhill Lake Group - with a corporate decline of 23 percent. The Transaction results in a 22,500 boepd (85 percent oil-weighted), light and medium gravity, intermediate, growth and dividend paying company. The MBOG Assets are located near Surge's core, waterflooded, light oil pools at Nipisi and Nipisi South in Western Alberta.

TRANSACTION HIGHLIGHTS

The Transaction has the following key benefits to Surge shareholders:

- 11 percent accretive to Surge's forecast 2019 adjusted funds flow per share;

- Increases oil and liquids weighting from 81 percent to 85 percent;

- Increases Surge's light oil weighting to 55 percent;

- Increases Surge's operating netback by 12 percent to over $31 per boe3;

- Lowers Surge's corporate decline to below 24 percent;

- Surge's all-in payout ratio1 improves to 87 percent from 89 percent, after accounting for the anticipated 25 percent increase to the annual dividend;

- Adds over 600 million barrels of net combined internally estimated OOIP under management; and

- Increases Surge's December 31, 2017 independently engineered net asset value (Sproule) from $6.06 per share to an estimated $6.52 per share4.

|

___________________________ |

|

1 Adjusted funds flow, adjusted funds flow per share, net operating income, and all-in payout ratio are non-IFRS measures. See the Non-IFRS Measures section in this press release. |

|

2 Original Oil in Place (OOIP) is the equivalent to Discovered Petroleum Initially In Place (DPIIP) for the purposes of this press release. "Internally estimated" means an estimate that is derived by Surge's internal APEGA certified Engineers and Geologists (who are also Qualified Reserve Evaluators) and prepared in accordance with National Instrument 51-101. |

|

3 Based on pricing averaging as follows: US$65.00WTI/bbl; CAD$86.67WTI/bbl; EDM CAD$77.33/bbl; WCS CAD $60.00/bbl; AECO $1.95/mcf |

Paul Colborne, President and CEO of Surge stated: "We believe that this Transaction is an exciting opportunity for both Surge and MBOG shareholders. Shareholders in the combined Company will participate in the newest, intermediate crude oil, growth and dividend paying company in Canada, while benefitting from Surge's exciting growth opportunities, our top tier all-in payout ratio, and Surge's excellent balance sheet; together with Mount Bastion's light oil netbacks, and its long life asset base".

The Transaction will be funded through a combination of cash, common shares of Surge, and the assumption of positive working capital from MBOG, structured to minimize dilution to Surge shareholders while improving Surge's balance sheet. The cash portion of the Transaction will be funded from the projected, revised credit facility and does not require any external financing.

The Company estimates that Q4 2019 net debt to annualized adjusted funds flow ratio will be 1.62 times. Surge estimates bank debt for the combined entity of $390 million at closing on a projected bank line of $525 million. The Company estimates that it will have approximately $135 million of undrawn credit avaibility at closing. All of the directors and officers of MBOG and its largest shareholder, collectively representing approximately 70 percent of the outstanding MBOG Shares, have entered into support and lock-up agreements to vote in favor of the Transaction and have agreed to certain escrow agreements with respect to any Surge Shares received from the Transaction for a period of nine months following the completion of the Transaction, subject to certain exceptions.

PROFORMA HIGHLIGHTS

Operational platform to continue to execute on sustainable growth plus income model:

- Over 2.4 billion barrels of net combined, internally estimated, conventional OOIP - with a 6.9 percent recovery factor to date;

- Combined proven plus probable year end 2017 reserves of over 120 million boe (90 percent oil);

- 22,500 boepd light and medium gravity oil producer (85 percent oil and liquids weighted);

- Combined forecasted 2019 adjusted funds flow of $230 million;

- Corporate base decline of less than 24 percent;

- Development drilling upside: >800 locations5 (internally estimated); provides drilling inventory of more than 10 years; and

- >14 year reserve life index (proved plus probable).

|

___________________________ |

|

4 Based on the independently evaluated total proved plus probable value presented in the Surge December 31, 2017 reserve report, and the Mount Bastion December 31, 2017 reserve report titled "Evaluation of the P&NG Reserves of Mount Bastion Oil & Gas Corp. (as of December 31, 2017) for Surge Energy Inc. using Surge Energy Inc.'s Development Plan", dated August 31, 2018. |

|

5 See Drilling Locations section of this press release. |

Financial platform to deliver low to mid double digit, all-in annual per share returns:

- Proforma operating netbacks of over $31 per boe at US $65 WTI per bbl;

- Forecasted full cycle corporate capital efficiencies of less than $25,000 per flowing boepd;

- Anticipated annual return components to include five to six percent growth in production per share, five percent dividend yield, and four to five percent free adjusted funds flow yield6 - for an estimated total annual shareholder return of approximately 15 percent;

- Liquidity – in excess of $135 million in undrawn capacity forecast on the expected combined bank line of $525 million;

- Post-closing, Surge estimates that the Company will have approximately $31 million of free adjusted funds flow in 2019 (i.e. over and above exploration and development capital expenditures and the anticipated, upwardly revised dividend) at US $65 WTI crude oil prices.

TRANSACTION METRICS

The Transaction has the following key characteristics:

|

Purchase Price |

$320 million |

|

Current Production |

5,500 boepd (98% light oil) |

|

Base Production Decline |

23% |

|

Proved plus probable reserves1 |

25 MMboe (98% oil) |

|

Proved plus probable RLI |

12.5 years |

|

2019 estimated operating netback2 |

> $42/boe |

|

Liability Management Rating ("LMR") |

2.71 |

|

Notes: |

|

1: Based upon Sproule's reserve report titled "Evaluation of the P&NG Reserves of Mount Bastion Oil & Gas Corp. (As of December 31, 2017) for Surge Energy Inc. Using Surge Energy Inc.'s Development Plan", dated August 31, 2018. |

|

2: Based on 2018 pricing averaging as follows: US$65.00WTI/bbl; CAD$86.67WTI/bbl; EDM CAD$77.33/bbl; WCS CAD $60.00/bbl; AECO $1.95/mcf |

The Transaction metrics are as follows:

|

2019 Net operating income multiple |

3.8x |

|

Production |

$58,182 / boepd |

|

Proved plus probable reserves |

$12.80 / boe |

|

Proved plus probable Recycle Ratio[7] |

> 3.2x |

|

___________________________ |

|

6 Free adjusted funds flow yield is calculated as free adjusted funds flow divided by the current number of basic shares outstanding. The resulting number is then divided by the current share price. |

|

7 Recycle ratio is calculated as operating netback of $42/boe divided by the cost of proved plus probably reserves of $12.80/boe. |

TRANSACTION DETAILS

The aggregate purchase price payable by Surge under the Transaction will be $320 million, to be paid, at the election of each holder of MBOG Shares, (i) in cash; (ii) common shares of Surge ("Surge Share"); or (iii) a combination of cash and Surge Shares as elected by such holder, subject in each case to proration, such that the aggregate consideration to be paid to holders of MBOG Shares will be $145 million in cash and 75,431,034 Surge Shares.

In addition, Surge anticipates that it will assume approximately $3 million of MBOG positive working capital8 (after transaction costs) upon completion of the Transaction.

All of the directors and officers of MBOG as well as MBOG's largest shareholder, collectively holding approximately 70 percent of the outstanding MBOG Shares, have entered into support and lock-up agreements pursuant to which they have agreed to vote their MBOG Shares in favor of the Transaction and have agreed to certain escrow agreements with respect to any Surge Shares received from the Transaction for a period of nine months following the completion of the Transaction, subject to certain exceptions.

|

__________________________ |

|

8 Working capital is calculated as current assets minus current liabilities, including transaction costs. |

STRATEGIC RATIONALE FOR TRANSACTION

Surge management has positioned the Company over the last three years of the crude oil price downturn to be able to identify and acquire complementary, large OOIP crude oil assets - as oil prices recover.

The Transaction is consistent with Surge's defined business model of acquiring operated, light and medium gravity crude oil reservoirs, with large OOIP and low recovery factors. MBOG's Assets include 5,500 boepd of which 98 percent is light crude oil production, located in Surge's NW Alberta core area, with an estimated 23 percent base decline. The business combination will result in a new intermediate company with over 22,500 boepd (85 percent oil and liquids), and annual base decline rate of less than 24 percent.

Production from the MBOG Assets is primarily from the structural reef complexes of the Beaverhill Lake Group – specifically the Slave Point formation. These structural reef build-ups (as opposed to the lower reservoir quality found in the regional Slave Point carbonate platform) have pay thicknesses of up to 22 meters, and porosity and permeability of up to 15 percent and 100 milliDarcy's respectively. The MBOG Assets have an internally estimated net OOIP of over 600 million barrels, with a low 6.6 percent recovery factor to date.

The MBOG Assets are focused in NW Alberta, located near Surge's core, waterflooded, light oil pools at Nipisi and Nipisi South. The MBOG Assets are over 90 percent operated, with over 80 percent working interests, and possess a reserve life index of 12.5 years (proved plus probable). In addition, a portion of the MBOG Assets are under waterflood.

Approximately 3,500 boepd of the MBOG Assets daily light oil production (i.e. greater than 55 percent) is generated from the 91 percent working interest, operated Sawn asset. The Sawn asset is a structural reef complex containing 208 million barrels of (net) internally estimated OOIP; it has a 6.6 percent recovery factor to date; and it is under waterflood.

Sawn currently has a 25 percent decline, a 15 percent royalty, and a netback of $45 per barrel at prices of US $65 WTI per barrel. Surge management recognizes significant additional upside at Sawn through full implementation of the waterflood across the entire field, together with infill and step-out development drilling.

Post-closing, Surge will have an internally estimated net OOIP of over 2.4 billion barrels of operated light and medium gravity crude oil under the Company's ownership and management. The current recovery factor on the combined internally estimated 2.4 billion barrels of net OOIP is approximately 6.9 percent, with over 800 internally estimated development drilling locations in inventory (>10 year drilling inventory). The MBOG Assets have extensive infrastructure in place to facilitate further development drilling and waterflood.

OUTLOOK; PROFORMA SURGE

Growth Strategy

Upon the completion of the Transaction, Surge's projected 2018 production exit rate is now expected to increase to more than 22,500 boepd (85 percent crude oil and liquids). Post-closing, Surge's corporate decline is expected to drop below 24 percent. The Company will have an estimated $31 million of free adjusted funds flow in 2019, over and above its annual exploration and development capital expenditure program and the upwardly revised dividend.

Surge management anticipate capital efficiencies to average less than $25,000 per flowing boepd across the proforma asset base.

In 2019 Surge will continue to focus growth capital towards high quality, large OOIP, light and medium gravity crude oil reservoirs. Management's primary goals for Surge include achieving five to six percent organic annual per share growth in reserves, production, and adjusted funds flow, maintaining and growing a sustainable dividend, continued debt reduction from the Company's free adjusted funds flow, together with the pursuit of high quality, accretive acquisitions.

Surge will also continue to maintain balance sheet flexibility with an effective risk management program that looks to protect the Company's capital program and dividend, and to pursue the Company's waterflood program. Management will continue to evaluate hedging up to 50 percent of Surge's net after royalty crude oil production for periods of up to 18 months.

An integral part of Surge's ongoing business strategy is to increase oil reserves and recovery factors throughout the Company's extensive crude oil portfolio through the continued implementation of waterflood projects, lowering corporate decline rates and maximizing shareholder value. The Company will also pursue continued, year over year increases in recovery factors from its portfolio of conventional light and medium crude oil assets through continued development activities, including in-fill and step out development drilling.

Dividend

Surge's dividend policy will continue to target a dividend payout ratio of 20 to 30 percent, and an all-in payout ratio in the range of 80 to 90 percent. Additional free adjusted funds flow beyond Surge's targeted five to six percent annual production growth will be allocated to an expanded capital program, debt repayment, dividend increases, or share buybacks.

Surge anticipates increasing its dividend by 25 percent, from $0.10 per share annually ($0.00833 per month) to $0.125 per share annually ($0.0104 per month), while improving Surge's all-in payout ratio from 89 percent to 87 percent. Any dividend increase will be subject to the approval of Surge's Board of Directors with consideration given to the business environment upon closing of the Transaction. This increase represents a dividend payout ratio of 17 percent of estimated 2019 adjusted funds flow at US $65 WTI crude oil pricing9.

The Transaction improves Surge's all-in payout ratio from approximately 89 percent to 87 percent. Post-closing, Surge estimates that the Company will have approximately $31 million of free adjusted funds flow (above exploration and development capital expenditures and Surge's upwardly revised dividend) at a crude oil price of US $65 WTI per bbl in 2019.

|

___________________________ |

|

9 Dividend payout ratio of 17 percent is calculated as follows: $39 million in estimated 2019 annual dividend expense divided by $230 million of forecast 2019 adjusted funds flow. |

Upward Revision to 2018 Exit Rate & Preliminary 2019 Guidance

The following is the Company's increased guidance for Surge's 2018 production exit rate target, as well as, preliminary guidance for 2019 (after giving effect to the Transaction):

|

Upwardly Revised Guidance |

Proforma the Transaction @ US $65 WTI |

Proforma the Transaction @ US $75 WTI |

|

|

Exit 2018 production (boepd) |

22,500 |

22,500 |

|

|

Average 2019 production (boepd) |

23,000 |

23,000 |

|

|

Exit 2019 production (boepd) |

23,500 |

23,500 |

|

|

% oil and NGL's |

85% |

85% |

|

|

2019 Adjusted Funds flow ($MM) |

$230 |

$287 |

|

|

Per basic share ($/sh) |

$0.74 |

$0.93 |

|

|

2019 Exploration and Development Capital Expenditures ($MM) |

$160 |

$160 |

|

|

2019 Dividend ($MM) |

$39 |

$39 |

|

|

2019 Free adjusted funds flow ($MM) |

$31 |

$88 |

|

|

2019 All-in payout ratio |

87% |

69% |

|

|

Q4 2019 Net debt to annualized adjusted funds flow |

1.62x |

1.16x |

|

|

___________________________ |

|

9 Dividend payout ratio of 17 percent is calculated as follows: $39 million in estimated 2019 annual dividend expense divided by $230 million of forecast 2019 adjusted funds flow. |

LEGAL TERMS OF THE TRANSACTION

The Transaction is expected to close in October 2018. Completion of the Transaction is subject to the approval of at least 66 2/3 percent of the MBOG shareholders and the issuance of Surge Shares to MBOG shareholders pursuant to the Transaction will be subject to the approval of at least a simple majority of the Surge shareholders. The meeting of Surge shareholders is currently expected to be held in mid-October 2018 and, in connection therewith, it is currently expected that a management information circular and proxy statement will be sent to Surge shareholders in mid-September 2018. Completion of the Transaction is also subject to, among other things, the receipt of court approval and other customary closing conditions.

All of the directors and officers of MBOG as well as MBOG's largest shareholder, collectively holding approximately 70 percent of the outstanding MBOG Shares, have entered into support and lock-up agreements pursuant to which they have agreed to vote their MBOG Shares in favor of the Transaction and have agreed to certain escrow agreements with respect to any Surge Shares received from the Transaction for a period of nine months following the completion of the Transaction, subject to certain exceptions.

Each of MBOG and Surge has agreed to pay a termination fee of $10.5 million to the other party in certain circumstances, including in the case of MBOG, if MBOG recommends, approves or enters into an agreement with respect to a superior proposal. MBOG has agreed not to solicit or initiate any discussions regarding any other acquisition proposals or sale of material assets. MBOG has also granted Surge a five business day right to match any superior proposal.

ADVISORS

Macquarie Capital Markets Canada Ltd. is acting as exclusive financial advisor to Surge with respect to the Transaction. McCarthy Tétrault LLP is acting as legal advisor to Surge with respect to the Transaction. GMP FirstEnergy and BMO Capital Markets have also been appointed strategic advisors to Surge.

CONFERENCE CALL DETAILS

A conference call hosted by Paul Colborne, President and CEO of Surge, will be held for the investment community to discuss the Transaction. Details of the conference call are as follows:

|

Date: |

Thursday, September 6, 2018 |

|

Time: |

6:45 am MT (8:45 am ET) |

|

Dial-In: |

1-888-241-0326 (toll free) |

|

International Dial-In |

647-427-3411 |

|

Conference ID: |

7978867 |

FORWARD LOOKING STATEMENTS:

This press release contains forward-looking statements. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: the Transaction, the impact of the Transaction on Surge and its results and development plans; MBOG and the MBOG Assets; anticipated Transaction consideration and form thereof; the expected closing date of the Transaction; mailing of the information circular related to the Surge shareholder meeting and the expected timing thereof; the expected timing of the Surge shareholder meeting; management's expectations with respect to the working capital of MBOG at closing; Surge's pro-forma operational and financial platform as a result of the Transaction; anticipated benefits of the Transaction, including but not limited to increased operating netbacks and other economies, capital efficiencies, increased free adjusted funds flow, adjusted funds flow and adjusted funds flow per share; increases in Surge's oil and liquids weighting and light oil weighting; Surge's all-in payout ratio; estimated Q4 net debt to annualized adjusted funds flow ratio; availability of free cash flow; expected increase to Surge's bank line post-closing; improvement of payout ratios; increased reserves and resources other than reserves; increased reserves life index; increased production exit rate and 2019 estimated production and growth in production per share, dividend yield, free adjusted funds flow yield, and estimated total annual shareholder return; forecast 2019 net operating income and 2019 net operating income multiple; recycle ratios; recovery factors; estimated future drilling locations and lowering of corporate decline rate; reserve life index; the anticipated LMR of Surge post-closing; management's expectations with respect to the development of the Sawn asset and other MBOG Assets; the fit and efficiencies of the MBOG Assets with Surge's existing assets; Surge's estimated total net debt post-closing; Surge's declared focus and primary goals; Surge's annual exploration and development capital expenditure program; potential for debt repayment or share buybacks; potential for continued cost-cutting; management's ability to maintain balance sheet flexibility; the effectiveness of Surge's risk management program; expectations of Surge's management with respect to Surge's waterflood program and results therefrom; and Surge's dividend policy and the expectations of management with respect to an increase to Surge's dividend upon completion of the Transaction.

The guidance for 2019 set forth in this press release may be considered to be future-oriented financial information or a financial outlook for the purposes of applicable Canadian securities laws. Financial outlook and future-oriented financial information and projected operational information contained in this press release are based on assumptions about future events based on management's assessment of the relevant information currently available. In particular, this press release contains projected financial information for 2019, including 2019 adjusted funds funds and on a per basic share basis, exploration and development capital expenditures, 2019 dividend, 2019 free adjusted funds flow, 2019 all-in payout ratio and Q4 2019 net debt to annualized adjusted funds flow. This press release also contains certain projected operational information, including 2018 exit production, average 2019 production and % oil and NGLs weighting. The future-oriented financial information and financial outlooks and projected operational information contained in this press release have been approved by management as of the date of this press release. Readers are cautioned that any such future-oriented financial information, financial outlooks and projected operational information contained herein should not be used for purposes other than those for which it is disclosed herein.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions concerning the timing of receipt of court, regulatory and shareholder approvals for the Transaction; the ability of Surge to execute and realize on the anticipated benefits of the Transaction; the satisfaction of all conditions for closing of the Transaction; the availability of capital to pay the cash portion of the purchase price at closing; the performance of existing wells and success obtained in drilling new wells; anticipated expenses, cash flow and capital expenditures; the application of regulatory and royalty regimes; prevailing commodity prices and economic conditions; development and completion activities; the performance of new wells; the successful implementation of waterflood programs; the availability of and performance of facilities and pipelines; the geological characteristics of Surge's properties; the geological characteristics of the MBOG Assets; the successful application of drilling, completion and seismic technology; the determination of decommissioning liabilities; prevailing weather conditions; exchange rates; licensing requirements; the impact of completed facilities on operating costs; the ability of Surge to increase its dividend post-closing; the availability and costs of capital, labour and services; and the creditworthiness of industry partners.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions, uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures or failure to obtain the continued support of the lenders under Surge's bank line. Completion of the Transaction could be delayed if parties are unable to obtain the necessary regulatory, stock exchange, shareholder and court approvals on the anticipated timeline. The Transaction may not be completed if all of these approvals are not obtained or some other condition of closing is not satisfied. Accordingly, there is a risk that the Transaction will not be completed within the anticipated time or at all. Certain of these risks are set out in more detail in Surge's Annual Information Form dated March 14, 2018 and in Surge's MD&A for the period ended June 30, 2018, both of which have been filed on SEDAR and can be accessed at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Reserves Data

Boe means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Boe/d and boepd means barrel of oil equivalent per day. Original Oil in Place ("OOIP") is the equivalent to Discovered Petroleum Initially In Place ("DPIIP") for the purposes of this press release. DPIIP is defined as quantity of hydrocarbons that are estimated to be in place within a known accumulation. There is no certainty that it will be commercially viable to produce any portion of the resources. A recovery project cannot be defined for this volume of DPIIP at this time, and as such it cannot be further sub-categorized. Bbl means barrel of oil. NGLs means natural gas liquids.

Drilling Locations

This press release discloses drilling locations in two categories: (i) booked locations; and (ii) unbooked locations. Booked locations are proved locations and probable locations derived from an internal evaluation using standard practices as prescribed in the Canadian Oil and Gas Evaluations Handbook and account for drilling locations that have associated proved and/or probable reserves, as applicable. Booked locations referenced in this press release account for all of Surge's Asset Acquisitions and Divestiture activity up to and including the date of the subject acquisition, reflecting the bookings that existed (from the respective 3rd party auditor), as of January 1, 2018. Booked locations referenced for Mount Bastion corporate acquisition are based upon Sproule's reserve report titled "Evaluation of the P&NG Reserves of Mount Bastion Oil & Gas Corp. (as of December 31, 2017) for Surge Energy Inc. using Surge Energy Inc.'s Development Plan", dated August 31, 2018; this sensitivity run removed 73 gross (54.0 net) economic locations from Sproule's original 2017 year end reserves, leaving 67 gross (60.7 net) economic locations booked as of December 31, 2017.

Unbooked locations are internal estimates based on prospective acreage and assumptions as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by Surge's internal APEGA certified Engineers and Geologists (who are also Qualified Reserve Evaluators) as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Assuming the January 1, 2018 reference date outlined above, the proforma company discussed in this press release will have over >800 gross (>800 net) drilling locations identified herein, of these >500 are unbooked locations. Of the 378 gross (345 net) booked locations identified herein 279 gross (258 net) are Proved locations and 95 gross (88 net) are Probable locations.

Non-IFRS Measures

This press release contains non-IFRS measures which do not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and therefore may not be comparable with the calculation of similar measures by other companies. Management uses these measures to analyze the performance, liquidity and sustainability of the Company and to compare the results of the Company with others in the industry. Non-IFRS measures used in this press release are as follows:

- Adjusted funds flows flow and adjusted funds flow per share – the Company's MD&A for the year ended December 31, 2017 provides the calculation of adjusted funds flow and what items are added or subtracted from cash flow from operations to arrive at adjusted funds flow. Adjusted funds flow per share is calculated by dividing adjusted funds flow by the weighted average number of shares outstanding for the period as used in the determination of earnings per share amounts. Adjusted funds flow should not be viewed as more relevant to the IFRS measure of cash flow from operations. This measure is used by management to analyze the cash flow of the Company and it is used in other metrics to assess liquidity and sustainability of the dividend.

- All-in payout ratio is calculated using the sum of development capital plus dividends paid divided by adjusted funds flow. Development capital is total capital expenditures in the period excluding acquisitions and proceeds on disposition.

- Free adjusted funds flow is calculated as adjusted funds flow less development capital and dividends and represents, in dollars, the excess of adjusted funds flows above development capital and dividends. Management uses this metric, along with the all-in payout ratio to assess whether adjusted funds flow is sufficient to fund the ongoing capital requirements of the Company whilst servicing the dividend. There is no IFRS equivalent metric to compare these calculations against.

- Dividend payout ratio is calculated as the dividend for the respective period divided by adjusted funds flow. The metric is used by management to analyze the level of dividends currently being paid on the stock in comparison to the cash being generated by the underlying business.

- Net debt is calculated as bank debt plus the liability component of the convertible debentures plus or minus working capital, however, excluding the fair value of financial contracts and other long term liabilities. This metric is used by management to analyze the level of debt in the Company including the impact of working capital, which varies with timing of settlement of these balances. Net debt to adjusted funds flow is calculated as net debt divided by adjusted funds flow for the period. This metric provides an indication of leverage and the number of years it would take to repay the net debt based on the level of adjusted funds flow.

- Q4 net debt to annualized adjusted funds flow is calculated by dividing net debt at the end of the period by adjusted funds flow for the respective quarter multiplied by four. Similar to net debt to adjusted funds flow this metric provides an indication of leverage and the number of years it would take to repay the net debt, however, it is based on annualizing the adjusted funds flow from the most recent quarter.

- Net operating income represents revenue net of royalties and operating, sales and transportation expenses. The Company believes that net operating income is a useful supplemental measure to analyze operating performance and provides an indication of the results generated by the Company's principal business activities prior to the consideration of other income and expenses.

- Net operating income multiple is calculated as the purchase price of an acquisition divided by the net operating income from the related acquisition. With respect to the MBOG Assets, the net operating income multiple is calculated as follows: Purchase price of $320 million divided by 2019 forecast net operating income from MBOG Assets of over $85 million. This non-IFRS measure is used by management to analyze the metrics of an acquisition. The net operating income multiple is calculated based on forecasted net operating income. Management does not forecast cash flow from operations, in part due to fluctuations in working capital, and hence there is no equivalent IFRS measure.

Additional information relating to non-IFRS measures can be found in the Company's most recent management's discussion and analysis MD&A, which may be accessed through the SEDAR website (www.sedar.com).

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Surge Energy Inc.