CALGARY, May 15, 2018 /CNW/ - Surge Energy Inc. ("Surge" or the "Company") (TSX: SGY) is pleased to announce the execution of a formal purchase and sale agreement for the acquisition (the "Acquisition") of high netback, waterflooded, crude oil producing assets (the "Assets") in the Company's core Sparky area of Central Alberta for a purchase price of $28.4 million, which is expected to close on or about May 31, 2018.

Current production from the Assets is more than 620 boepd (83 percent oil), with over 75 percent of the production focused in Surge's large original oil in place ("OOIP"1), high netback, core Sparky crude oil properties at Eyehill and Macklin. The Assets have an annual decline of less than 27 percent, and a netback of more than $30 per boe at US $65 WTI2 per barrel oil prices. The Acquisition is accretive to Surge on all key debt adjusted per share metrics. Surge has identified more than 35 net low-risk Sparky development drilling locations on the Assets. The Assets have a large internally estimated OOIP of over 85 million barrels, and an average gravity of 27o API.

In conjunction with the Acquisition, Surge is also revising upward the Company's 2018 exit production guidance from 16,650 boepd to 17,175 boepd (82 percent oil).

In addition, as a result of better than anticipated Q1 2018 drilling and waterflood results (as Press Released on May 8, 2018), the Sparky core area Acquisition, significantly higher strip crude oil prices than estimated, and the narrowing of WCS differentials to near historical levels, Surge is generating substantial free adjusted funds flow, (resulting in an estimated dividend simple payout ratio of less than 15 percent) at current strip crude oil prices. Accordingly, Surge's Board of Directors has approved an increase to the Company's annual dividend from $0.095 per share per year ($0.0079 per share per month) to $0.10 per share per year ($0.0083 per share per month).

______________________

|

1 |

Original Oil in Place ("OOIP") is the equivalent to Discovered Petroleum Initially In Place ("DPIIP") for the purposes of this press release. |

|

2 |

2018 guidance and Acquisition metrics are based off of US$65/bbl WTI, US$47/bbl WCS, 0.78 CAD/USD FX, $1.40/GJ AECO. |

THE SPARKY ACQUISITION

The Acquisition is consistent with Surge's business strategy of acquiring high quality, operated, large OOIP, conventional crude oil, sandstone reservoirs with low recovery factors.

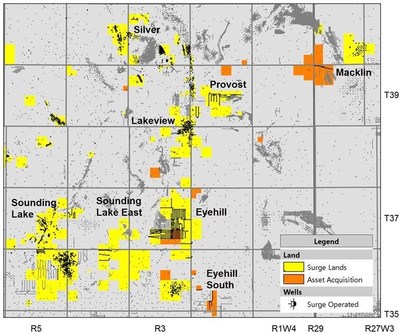

The Assets are located in the Company's Sparky core area trend in which Surge currently has over 700 million barrels of internally estimated net OOIP. The Eyehill and Macklin properties included in the Acquisition represent over 75 percent of the current production from the Assets, and directly offset Surge's current production and drilling operations. Surge has identified over 35 net low-risk drilling locations, with additional waterflood upside on these two key properties. The Assets are characterized by the following attributes:

- More than 85 million barrels of internally estimated OOIP with current recovery factors of less than 2 percent at Eyehill and Macklin (and an internally estimated recovery factor of 10 percent on primary, and up to 30 percent with waterflood);

- 620 boepd (83 percent oil) of 100 percent operated, high working interest, low decline, oil-weighted production;

- Long life reserves – over 2.9 mmboe of internally estimated proved plus probable reserves (i.e. 13 year RLI);

- A portion of the production is under successful, active waterflood (with additional waterflood upside at both Eyehill and Macklin);

- More than 35 net low-risk, development drilling locations, of which 11 are included in Surge's internal reserve estimates above;

- Operating netbacks of more than $30 per boe at US $65 WTI;

- Sustaining capital of $3.25 million, with anticipated 2H 2018 annualized adjusted funds flow of more than $6.0 million; and

- Implied free cash flow yield of approximately 45 percent.

ATTRACTIVE DEAL METRICS

The $28.4 million Acquisition has the following transaction metrics:

|

Current Production Multiple |

620 boepd (83 percent oil); |

|

2H 2018 Annualized Adjusted Funds Flow Multiple3 |

4.7x |

|

Total Proved Plus Probable Reserves Multiple (Internally Estimated) 4 |

$9.79/boe |

|

Recycle Ratio |

3.1x |

|

Reserve Life Index (RLI) |

13 years |

______________________

|

3 |

2018 guidance and Acquisition metrics are based off of US$65/bbl WTI, US$47/bbl WCS, 0.78 CAD/USD FX, $1.40/GJ AECO. |

|

4 |

RLI defined in Reserves Data/Oil and Gas Metric |

This Acquisition is accretive on all key debt adjusted per share metrics.

STRATEGIC FIT WITH SURGE'S CORE SPARKY ASSETS

Production in Surge's Sparky core area has increased 145 percent over the last 2 years, from 2,850 boepd to over 7,000 boepd (85 percent oil) today. Each of Surge's core assets depicted below can be characterized as a high quality, low risk, operated, large OOIP, conventional sandstone reservoirs.

SPARKY AREA – CONTINUED GROWTH MOMENTUM

Over the last 2 years, Surge has successfully grown production in the Company's Sparky core area by more than 145 percent – turning its key producing Sparky asset base into a low cost, high netback, conventional sandstone resource play.

Over the past 12 months Surge has successfully completed three separate accretive Sparky core area acquisitions, purchasing over 2,200 boepd (90 percent oil) combined, for an average of less than five times forward adjusted funds flow from the acquired assets. The combination of these transactions, together with Surge's highly successful development drilling program, have allowed the Company to amass an exciting core growth area with the following characteristics:

- Since year end 2016, Surge has increased the Company's internally estimated net OOIP in the Sparky core area to over 700 million net barrels, and added more than 125 internally estimated drilling locations;

- Surge's proved plus probable oil reserves in the Sparky core area have grown by more than 75 percent from 18 million boe (independently evaluated year end 2015 Sparky area reserves), to an internal estimate of more than 32 million boe today;

- Production from Surge's Sparky core area has increased by over 145 percent in the last 2 years from approximately 2,850 boepd to over 7,000 boepd today (85 percent oil);

- Today Surge has more than 340 internally estimated, low risk, Sparky area, development drilling locations – providing shareholders with a 12-year inventory of high rate of return (and excellent profit to investment ratio) locations at strip oil prices; and

- In addition, Surge is now experiencing significant economies of scale based upon regional dominance in this key growth area in terms of services, land, infrastructure, and existing production.

Management sees further opportunity to both expand and consolidate Surge's position in the Sparky core area, utilizing the following strategies: 1) organically grow through land acquisitions and follow-up development drilling; and 2) actively pursue, evaluate, and transact on accretive acquisitions of large OOIP, long life, low decline, conventional sandstone reservoirs.

Surge has now identified and delineated several distinct assets in its Sparky core area that will underpin growth in the area for the foreseeable future. The Company's key operated, large OOIP, sandstone reservoirs at Eyehill, Lakeview, Sounding Lake, Sounding Lake East, Betty Lake, Provost, and Macklin all possess multi-year development drilling inventories, exciting growth prospects, and waterflood upside.

Overall, the Company anticipates its Sparky core area to grow from 7,000 boepd currently, to over 10,000 boepd over the next three to four years.

UPWARD REVISION TO 2018 EXIT GUIDANCE

Based on better than anticipated drilling and waterflood results, (as Press Released on May 8, 2018), Surge's Q1 2018 production of 16,027 boepd again exceeded managements budgeted expectations.

In accordance with the Acquisition, Surge is now revising upward the Company's 2018 production exit rate from 16,650 boepd to more than 17,175 boepd. Surge has now revised upward the Company's production estimates five times in the last 2 years (i.e. two times organically and three times pursuant to core area acquisitions).

Surge's upwardly revised guidance for 2018 is set forth below:

|

OPERATIONAL |

US $65 WTI 2018 |

US $75 WTI 2018 |

|

2018 Average Production (boe/d) |

16,585 |

16,585 |

|

2018 Exit Production (boe/d) (82 percent oil) |

17,175 |

17,175 |

|

Total 2018 Capital Spending |

$105 million |

$105 million |

|

Operating Expenses - 2H 2018 ($/boe) |

$13.95/boe |

$13.95/boe |

|

Transportation Expenses – 2H 2018 ($/boe) |

$1.50/boe |

$1.50/boe |

|

Royalties as a % of Revenue – 2H 2018 |

14-15% |

15-16% |

|

FINANCIAL

|

||

|

Estimated 2H 2018 Annualized Adjusted Funds Flow |

$149 million |

$190 million |

|

Estimated 2H 2018 Annualized Adjusted Funds Flow per Share |

$0.65 |

$0.82 |

|

Estimated Q4 2018 Net Debt to Adjusted Funds Flow |

1.66x |

1.2x |

|

Annualized Dividend |

$23.1 million |

$23.1 million |

|

Sustainability Ratio – 2H 2018 Annualized |

86% |

67% |

|

Simple Payout Ratio – 2H 2018 Annualized |

16% |

12% |

|

*Note: |

In 2017 Surge budgeted WCS differentials at US$12.75 per bbl. Surge has now increased its WCS differential |

______________________

|

5 |

2018 guidance and Acquisition metrics are based off of US$65/bbl WTI, US$47/bbl WCS, 0.78 CAD/USD FX, $1.40/GJ AECO. |

|

6 |

2018 guidance and Acquisition metrics are based off of US$75/bbl WTI, US$56/bbl WCS, 0.79 CAD/USD FX, $1.40/GJ AECO. |

Based on better drilling results than anticipated at the Company's core Valhalla light oil property, Surge has added one net Valhalla well in the fall of 2018 to its capital expenditure budget, plus $1 million of incremental facilities capital to handle the associated light oil volumes.

5.3 PERCENT INCREASE TO DIVIDEND

As a result of the Sparky core area Acquisition, along with better than anticipated operational results in Q1 2018, significantly higher strip WTI oil prices than the Company was budgeting, as well as WCS crude oil differentials narrowing close to long term average levels, Surge has much larger free adjusted funds flow in 2018 than management was projecting.

Accordingly, with the ongoing protection from Surge's strategic commodity hedging program, the Board and management of Surge intend to increase the Company's dividend by 5.3 percent, from $21.9 million annually to approximately $23.1 million annually, effective June 15th, 2018.

This equates to a simple payout ratio of less than 16 percent of forecast 2H 2018 annualized adjusted funds flow at WTI crude oil prices of US $65 WTI per barrel, including a WCS differential assumption of US$18 per barrel.

OUTLOOK – SUSTAINABLE GROWTH, LONG TERM VALUE, AND INCOME

Management's stated goal is to be the best positioned light/medium gravity crude oil growth and dividend paying public company in our peer group in Canada.

Over the last seven financial quarters, Surge has now increased production per share by 25 percent, increased its dividend by 31 percent, and upwardly revised production estimates five times – twice times organically, and three times pursuant to accretive Sparky core area acquisitions.

Management attributes the Company's continued quarterly operational outperformance to be a direct result of applying growth capital to Surge's high quality, large OOIP, light and medium gravity crude oil, conventional sandstone reservoirs, and successful waterflood implementation.

Management believes that Surge offers its shareholders a unique return based model with multi-faceted, low risk, light and medium gravity crude oil investment opportunity as follows:

- Sustainable annual production per share growth of five to seven percent per year pursuant to the Company's strategic Five Year Business Plan; plus

- Very high internal rate of return drilling locations – with very quick payouts (11 year drilling inventory; with a weighted average internal rate of return greater than 90 percent at US $65 WTI flat pricing); plus

- Significant incremental long-term value from Surge's large OOIP conventional reservoirs that have very high profit to investment ratio waterfloods (low risk drilling and waterfloods provide low harmonic declines, and deliver "annuity-type" annual reserve bookings); plus

- Current yield of approximately four percent through a sustainable, increasing, compounding dividend; plus

- Free adjusted funds flow yield (above US $57.50 WTI flat pricing); plus

- Significant financial leverage to higher oil prices; plus

- Significant upside for share price appreciation as Surge common shares trade up to (and through) the Company's new net asset value of $6.06 per share (calculated based on the Company's December 31, 2017 independently estimated (Sproule) reserve report total proved plus probable value, discounted at 10 percent).

Surge will continue to grow its production base and location inventory in the Company's three core areas - at Sparky, Shaunavon, and Valhalla – through, organic, low risk, development drilling, combined with strategic, high quality, core area acquisitions.

FORWARD LOOKING STATEMENTS:

This press release contains forward-looking statements. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: the closing of and anticipated benefits of the Acquisition; the impact of the Acquisition on the Company and its results and development plans; the expected characteristics of the Assets;; management's plans for development in certain core areas and the expected upside of such development; the fit of the Assets with the Company's existing assets; the expected closing date of the Acquisition;; production volumes; expected drilling activities and locations; Surge's capital expenditure program, including drilling and development plans and enhanced recovery projects and the timing and results to be expected thereof; expectations with respect to the Company's ability to operate and succeed in the current commodity price environment; the Company's declared focus and primary goals; the Corporation's Five Year Business Plan; management's forecast of adjusted funds flow ratio; guidance with respect to 2018 average and exit production and production per share; free adjusted funds flow; management's intention to increase Surge's dividend and the timing thereof the sustainability of the dividend; simple payout ratio; sustainability; recycle ratios; recovery factors; estimated reserves multiples; operating netbacks; management's estimates and expectations regarding capital expenditures, operating costs, transportation expenses, growth opportunities and strategies, estimated reserves and estimated reserve life index and decline rates; the Company's revised 2018 exit guidance; the availability of Surge's bank line to provide the Company with sufficient liquidity and financial flexibility; expected shareholder return; the potential appreciation of the Company's shares; the impact of cost savings initiatives; production and cash flow per share growth; and anticipated commodity prices; drilling inventories and locations; and management's expectations regarding debt levels.

Certain measures set forth in this press release may be considered to be future-oriented financial information or a financial outlook for the purposes of applicable Canadian securities laws. Financial outlook and future-oriented financial information contained in this press release are based on assumptions about future events based on management's assessment of the relevant information currently available. In particular, this press release contains projected operational information for 2018, including sustaining capital, average production, exit production, total capital spending, royalties, operating expenses, transportation expenses, annualized dividend, anticipated annual cash flow from operating activities, implied cash flow yield, forward adjusted funds flow, 2018 corporate operating costs, simple payout ratio, estimated 2018 adjusted funds flow and estimated 2018 adjusted funds flow per share. The future-oriented financial information and financial outlooks contained in this press release have been approved by management as of the date of this press release. Readers are cautioned that any such financial outlook and future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed herein.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions concerning the performance of existing wells and success obtained in closing the Acquisition, drilling new wells, anticipated expenses, cash flow and capital expenditures, the application of regulatory and royalty regimes, prevailing commodity prices and economic conditions, development and completion activities, the performance of new wells, the successful implementation of waterflood programs, the availability of and performance of facilities and pipelines, the geological characteristics of Surge's properties and the Assets, the successful application of drilling, completion and seismic technology, the determination of decommissioning liabilities, prevailing weather conditions, exchange rates, licensing requirements, the impact of completed facilities on operating costs and the availability, costs of capital, labour and services and the creditworthiness of industry partners and the impact of transactions on Surge's bank line.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects, capital expenditures or the closing of the Acquisition; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions, uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures or failure to obtain the continued support of the lenders under Surge's bank line. Certain of these risks are set out in more detail in Surge's Annual Information Form dated March 14, 2018 and in Surge's MD&A for the period ended March 31, 2018, both of which have been filed on SEDAR and can be accessed at www.sedar.com.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Reserves Data/Oil and Gas Metric

"Boe" means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. "Boe/d" and "boepd" mean barrel of oil equivalent per day. Original Oil in Place ("OOIP") is the equivalent to Discovered Petroleum Initially In Place ("DPIIP") for the purposes of this press release. DPIIP is defined as quantity of hydrocarbons that are estimated to be in place within a known accumulation. There is no certainty that it will be commercially viable to produce any portion of the resources. A recovery project cannot be defined for this volume of DPIIP at this time, and as such it cannot be further sub-categorized. "Internally estimated" means an estimate that is derived by Surge's internal APEGA certified Engineers, and Geologists and prepared in accordance with National Instrument 51-101 - Standards of Disclosure for Oil and Gas Activities. All internal estimates contained in this new release have been prepared effective as of May 1, 2018 The "recycle ratio", equals the profit per barrel divided by the total cost of discovering and extracting that barrel. "Total proved plus probable reserves multiple" is the purchase price of the Assets ($28.4 million) divided by the internally estimated total proved plus probable reserves (2.9 mmboe). "Corporate production efficiency" is equal to the total capital spent divided by the associated production added. "Internal rate of return" means the discount rate at which the net present value equals zero. "RLI" means reserve life index and equals the estimated remaining reserve divided by the current production.

Drilling Inventory

This press release discloses drilling locations that are booked locations as well as unbooked locations. Proved locations and probable locations, which are sometimes collectively referred to as "booked locations", are derived from the independent engineering evaluation of the oil, natural gas liquids and natural gas reserves attributable to the Company prepared by Sproule Associates Limited effective December 31, 2017 and dated February 9, 2018 (the "Sproule Report") and account for drilling locations that have associated proved or probable reserves, as applicable. Unbooked locations are internal estimates based on the Company's prospective acreage and an assumption as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Of the Company's more than 700 gross (675 net) drilling locations identified herein 420 gross (404 net) are unbooked locations. Of the 292 gross (277 net) booked locations identified herein 228 gross (216 net) are proved locations and 64 gross (61.2 net) are probable locations as of the Sproule Report. Unbooked locations have specifically been identified by management as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves data on prospective acreage and geologic formations. The drilling locations on which we actually drill wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results and other factors.

Non-IFRS Measures

This press release contains the terms "adjusted funds flow", "net debt", "net debt to adjusted funds flow", "operating netback", "sustainability", "sustaining capital", "payout ratio" "free adjusted funds flow yield", and "annualized adjusted funds flow multiple" which do not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and therefore may not be comparable with the calculation of similar measures by other companies. Management uses "adjusted funds flow" (cash flow from operating activities before changes in non-cash working capital, decommissioning expenditures, transaction and other costs and cash settled stock-based compensation) to analyze operating performance and leverage. Management believes that adjusted funds flow is a useful supplemental measure as it provides an indication of the results generated by the Company's principal business activities before the consideration of how those activities are financed or how the results are taxed. Management defines net debt as outstanding bank debt and the liability component of the convertible debenture plus or minus working capital, excluding the fair value of financial contracts and other current obligations. Management uses "net debt to adjusted funds flow" to analyze leverage and capital structure. Management believes "operating netback" is a useful supplemental measure of the amount of revenues received after royalties and operating and transportation costs and secondly, the amount of revenues received after the royalties, operating, transportation costs, general and administrative costs, and financial charges. Sustainability is a comparison of a company's cash outflows (capital investment and dividends) to its cash inflows (adjusted funds flow) and is used by the Company to assess the appropriateness of its dividend levels and the long-term ability to fund its development plans. Sustainability ratio is calculated using the development capital plus dividends paid divided by adjusted funds flow. Sustaining capital is the amount of capital investment required to maintain production at a current rate. Payout ratio is calculated on a percentage basis as dividends declared divided by adjusted funds flow. Payout ratio is used by management to monitor the dividend policy and the amount of adjusted funds flow retained by the Company for capital reinvestment. Free cash flow yield is calculated using annualized adjusted funds less sustaining capital investment divided by adjusted cash flow. Annualized adjusted funds flow multiple means the purchase price divided by the annualized adjusted funds flow. Additional information relating to these non-IFRS measures can be found in the Company's most recent management's discussion and analysis MD&A, which may be accessed through the SEDAR website (www.sedar.com).

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Surge Energy Inc.